Municipal Renewable Revenues Reach $70M in Alberta, but Future Growth Uncertain

November 25, 2025

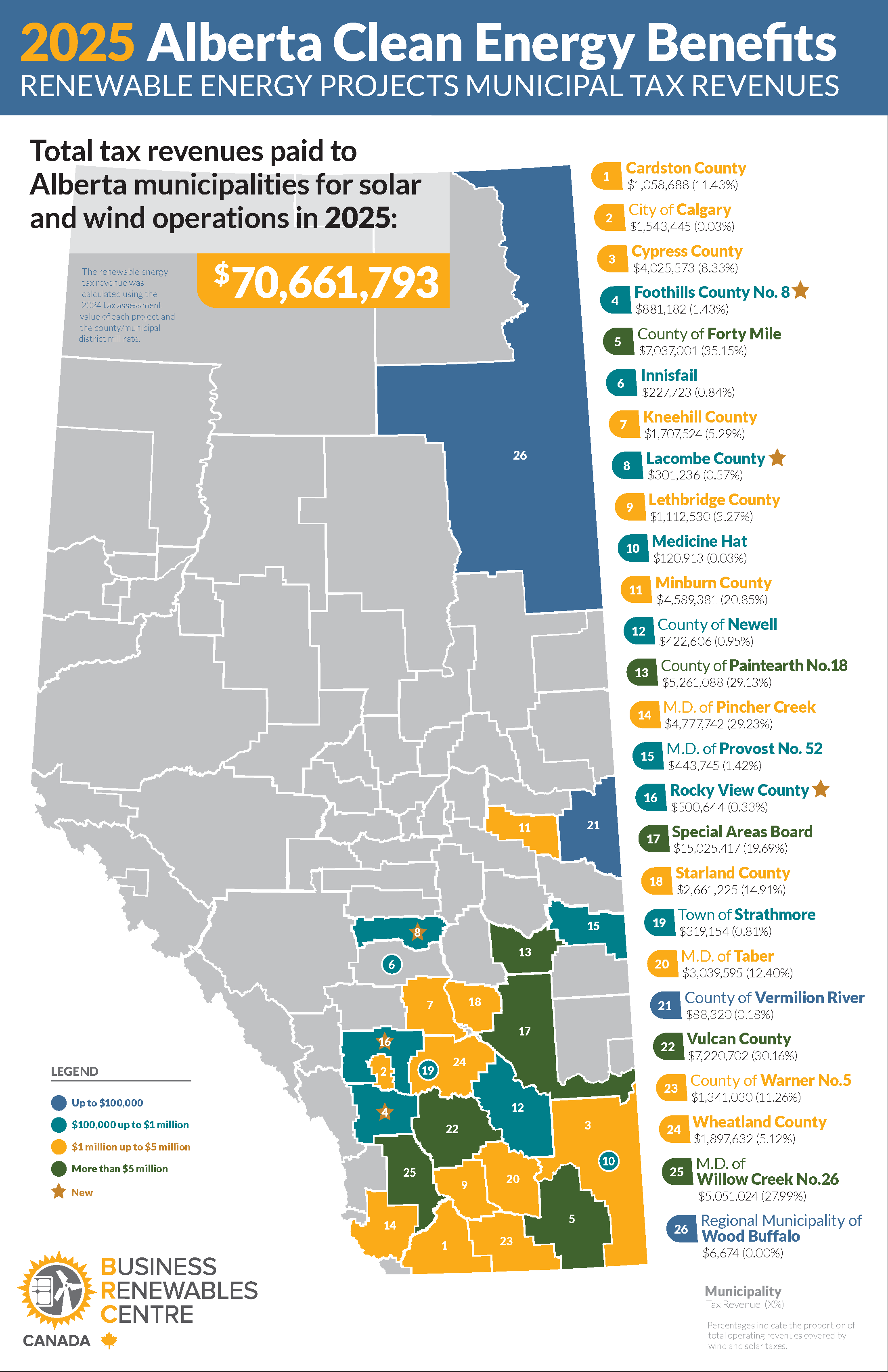

Albertan municipalities collected a record $70 million in tax revenues from wind and solar projects this year, marking a 30 per cent increase from last year, according to new analysis by the Business Renewables Centre-Canada. But this may represent a peak rather than a trend.

“Municipal tax revenues amounted to $70 million this year, up from $54 million last year and $28 million in 2023,” said Jorden Dye, director of BRC-Canada. “While existing projects provide reliable, stable income that communities can plan around for decades to come, the pipeline of new projects that could have sustained this growth trajectory has stalled.”

The substantial revenue growth stems from 20 new wind and solar projects totaling approximately 1.3 GW of capacity that became operational and were assessed for the first time this year. A third of Alberta counties now benefit from renewable energy tax revenues, with four new counties joining the list of 26 municipalities. However, these projects were all approved and initiated before Alberta’s policy environment shifted dramatically in 2023, resulting in a moratorium on new projects and the introduction of significant restrictions that limit landowners’ ability to lease their lands for renewable energy development.

“Existing projects will continue generating steady tax revenue, and that’s valuable,” said Dye. “But the growth municipalities have enjoyed – 30 per cent this year, 151 per cent over three years – requires new projects. And right now, Alberta’s renewable energy development has hit a wall.”

Following a seven-month moratorium in 2023 and new restrictive regulations in 2024, only 58 megawatts of new corporate renewable energy deals have been announced in 2024 and 2025, a 96 per cent drop from the two previous years. Alberta’s competitiveness has eroded just as other provinces begin to open their markets.

BRC-Canada’s analysis of the AESO project queue reveals both significant potential and mounting losses. While 21 counties could theoretically gain over $76 million from projects currently in development, including seven counties that would welcome renewable energy projects for the first time, project cancellations over the past year have already resulted in 27 counties losing approximately $84 million in potential future revenue.

“The math is stark,” said Dye. “We’re losing more in cancelled projects – $84 million – than we gained in new revenue this year. Counties that have positioned themselves for renewable energy development are watching opportunities evaporate. Without a clear, competitive policy framework, this $70 million will be remembered as a high-water mark, not a stepping stone.”

The corporate procurement market that drove much of Alberta’s renewable energy growth has collapsed. Between 2019 and 2023, corporate power purchase agreements enabled 4.1 GW of project capacity in Alberta. Since the policy changes, that market has virtually disappeared, with developers and corporate buyers increasingly looking to other jurisdictions.

The 2025 municipal tax revenue map may highlight the geographic distribution of renewable energy benefits across Alberta, but it also serves as a snapshot of what could have been and what may not continue without decisive policy action to restore market confidence and competitive advantage.

“Alberta municipalities are collecting record revenues today from decisions made years ago,” Dye said. “But those future decisions that would have driven growth in 2027, 2028, and beyond? Many of them have already been cancelled. This growth won’t continue on its own – it requires a policy environment that attracts investment rather than driving it away.”

Quick facts

- Currently, 37 solar and 49 wind projects provide tax revenues to 26 different rural municipalities in Alberta.

- From January 2019 to October 2025, 3.32 gigawatts (GW) of renewable energy have been purchased through PPAs in Alberta, enabling 4.77 GW of project capacity. This equates to 12,400 gigawatt-hours per year of energy provided, leading to:

- the creation of 6,200 jobs,

- $6.4 billion in capital investment, and

- production of enough energy to power 1.7 million homes.