Canada Returns to Being a Net Electricity Exporter in May 2024

August 15, 2024

Production of primary energy increased 4.6% to 1.9 million terajoules in May on the strength of crude oil and natural gas. Secondary energy production fell 4.0% due to a decline in refined petroleum products.

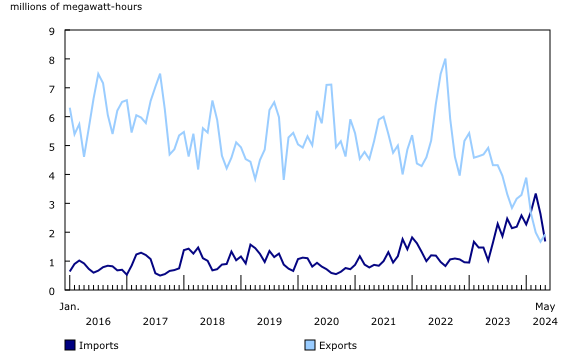

Canada returns to being a net electricity exporter in May

Following three consecutive months of electricity imports surpassing exports, Canada returned to being a net electricity exporter in May. Nevertheless, exports of electricity to the United States were down 60.7% year over year to 1.9 million megawatt-hours (MWh), just slightly higher than imports (+65.6% to 1.7 million MWh).

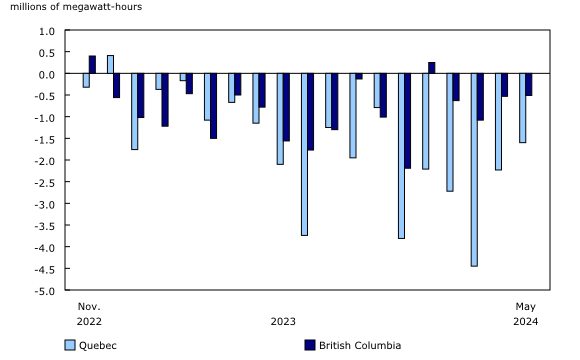

Canadian electricity generation fell 7.6% year over year to 44.3 million MWh in May. Hydroelectric generation (-12.8% to 25.2 million MWh) accounted for most of the overall decline, as ongoing drought conditions have suppressed hydroelectric generation across Canada. Nationally, Canada has not seen a year-over-year increase in hydroelectric generation since March 2023. Quebec, Canada’s most prolific hydroelectric generator, has recorded year-over-year declines since January 2023, while British Columbia, Canada’s second-largest producer, has seen just one modest increase (January 2024) since December 2022.

Nuclear generation in Canada was also down in May 2024 (-18.1%) as Ontario’s Bruce and New Brunswick’s Point Lepreau nuclear generating stations continued to undergo planned maintenance which began in April.

May’s decline in total electricity generation was partially offset by increases from combustible fuels (+11.2% to 9.9 million MWh) and wind (+7.8% to 3.3 million MWh).

Crude oil production continues to rise

Production of crude oil and equivalent products rose 7.3% to 23.7 million cubic metres in May 2024 due to a more intensive spring 2023 turnaround. The increase also reflected the change in production levels compared to May 2023, when the threat of forest fires disrupted production. This was the eighth consecutive monthly year-over-year increase in production.

Oil sands extraction was up 6.5% year over year to 15.1 million cubic metres in May 2024, driven by crude bitumen production (+13.4% to 10.1 million cubic metres). Partially offsetting the overall gain was a 5.0% decline in synthetic crude production as planned maintenance was underway at several upgraders in May.

The newly expanded Trans Mountain Pipeline began operation in May 2024, transporting crude oil and refined petroleum products from Edmonton, Alberta to the port of Burnaby, British Columbia. This expansion nearly triples the capacity of the existing pipeline built in 1953, opening more Canadian crude oil for export to the global market.

Production and exports of natural gas rise relative to one year ago

Production of marketable natural gas climbed 7.4% year over year in May 2024 to 655.3 million gigajoules. In May 2023, natural gas production was reduced due to forest fires across Alberta. On a month-over-month basis, the average daily production was down 3.2% in May 2024.

Total deliveries of natural gas to Canadian consumers rose 6.1% to 361.9 million gigajoules in May. Industrial consumption (+7.6%) increased year over year for the 15th consecutive month while the commercial and institutional (-1.7%) and residential (-1.6%) sectors edged down. Industrial consumption includes natural gas used for electricity generation and crude oil production.

Exports of natural gas to the United States rose 8.4% year over year to 261.8 million gigajoules in May. Like production, exports were also restrained by forest fires in May 2023.

Go HERE for more informaiton