Alberta Lifts Moratorium on Renewable Energy but Some Uncertainty Remains for the Industry

March 14, 2024

The Alberta government has issued its first set of policy guidelines following their moratorium on renewable energy development based on the report compiled by the Alberta Utilities Commission (AUC). A second policy letter will be issued (Module B, due at the end of March) with further policy directives after a review of AUC’s ‘second report’.

As a result of the ‘Module A’ report, which comes into effect March 1st, the province has taken an “agriculture first” approach when evaluating proposed agricultural lands for renewable energy projects.

The province will no longer permit renewable generation developments on Class 1 and 2 lands unless the proponent can demonstrate the ability for both crops and/or livestock to coexist with the renewable generation project. They will also establish the tools necessary to ensure Alberta’s native grasslands, irrigable, and productive lands continue to be available for agricultural production. Although specific tools have not been identified in their initial press release.

Renewable energy project developers will be responsible for reclamation costs via bond or security. The reclamation costs will either be provided directly to the Alberta government or may be negotiated with landowners if sufficient evidence is provided to the AUC.

Where some frustration lies for the renewable industry is in the subjective rules that have been issued without clear definitions. The government has added a 35 kilometre “buffer zone” around protected areas, as well as what the province designated as “pristine viewscapes”. Uncertainty remains on the definitions of “protected areas” and “pristine viewscapes”. New wind projects will not be permitted within “buffer zones”, while other developments will be subject to a visual impact assessment.

“While the Pause has lifted, there remains significant uncertainty and risk for investors wishing to participate in Canada’s hottest market for renewables. It is critical to get these policy changes right, and to do so quickly,” commented Vittoria Bellissimo, CanREA’s President and CEO.

CanREA notes that the impact of the moratorium will be seen in the coming years. The organization “participated actively” in AUC’s inquiries and met with Premier Smith and Minister Neudorf.

“CanREA will continue to consult with the AUC and encourage the province to provide clarity on policy changes that will enable paused projects to move forward, in a manner that will restore investor confidence in Alberta.”

Evan Wilson, Vice President of Policy—Western Canada and National Affairs at CanREA.

As part of the announcement, renewable energy development on Crown land will be conducted on a case-by-case basis, “Meaningful engagement will be required before any policy changes for projects on Crown land and would not come into effect until late 2025.” CanREA’s release on the announcement notes that their organization pushed for renewable development on Crown lands.

Another positive is that municipalities now have the right to participate in AUC hearings, and are eligible to request cost recovery for participation. They will have the ability to review “rules related to municipal submission requirements while clarifying consultation requirements.”

“CanREA is pleased with policy announcements on the issues of crown lands, municipal participation and reclamation security, but concerned about the announcements on agricultural land bans and “pristine viewscape” setbacks. Wind energy and solar energy have a long record of co-location with productive agricultural land use. CanREA will work with the government and the AUC to seek opportunities to continue these beneficial approaches,” the organization said in their release.

Clean Energy Canada’s Evan Pivnick has also released a statement commenting on the results of the moratorium and is critical of the impact subjective rules will have on future development.

“…the new path forward leaves even more unanswered questions for the industry. Indeed, there are major concerns that rules, like those concerning ‘viewscapes,’ will be arbitrarily applied. Meanwhile, initial analysis suggests that a requirement for the proposed 35-kilometre buffer around protected areas may prohibit wind development in 76% of southern Alberta,” he said.

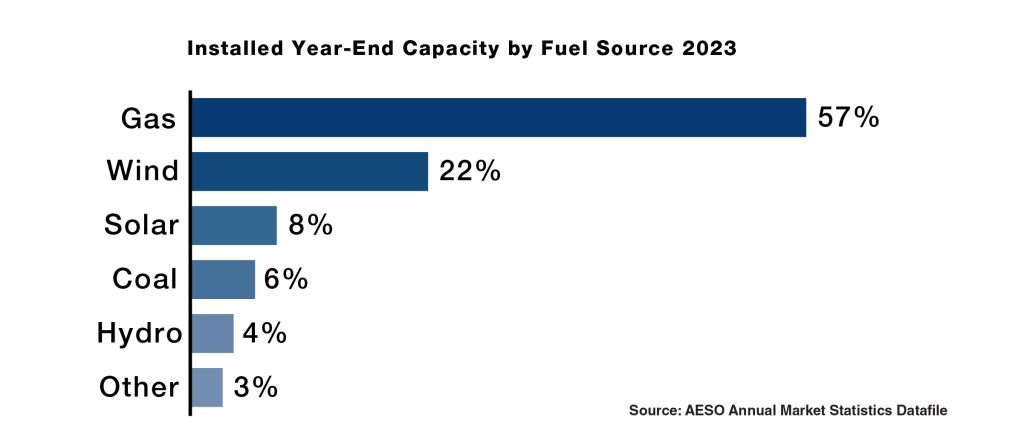

Alberta Energy Mix

The initial analysis Pivnick sites is from Simon Dyer of the Pembina Institute. According to Dyer, a majority of southern Alberta will be unavailable for renewable energy development. However, the province still has to define ‘protected areas’ and ‘pristine viewscapes’ as they relate to renewable development.

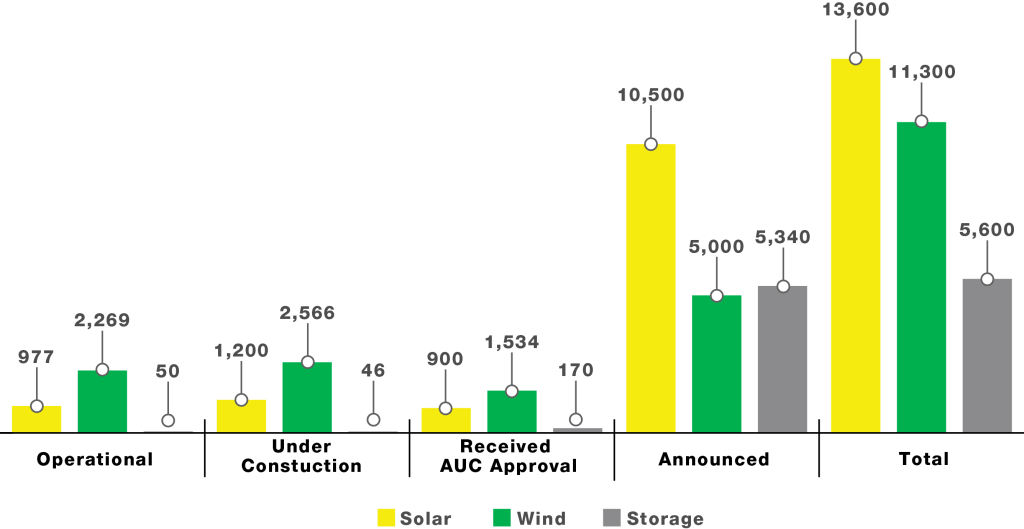

Alberta Renewables

Jason Wang, Senior Analyst at the Pembina Institute was also critical of Alberta’s approach, particularly with respect to land use and the ‘buffer zone’.

“These restrictions – that do not apply to other industries or land uses – will lead to fewer projects, slow the growth of clean and inexpensive electricity, and curtail an otherwise reliable and growing source of municipal tax revenue.”

“No other land use in Alberta is subject to a ban on certain classes of agricultural lands, or not allowed to develop if they are within a 35 km radius of a protected area – a zone that could cover up to 76% of southern Alberta.”

Wang says that if the current proposed projects go through, they are expected to account for $227 million in annual revenue for Alberta municipalities by 2028. The renewable industry is becoming increasingly competitive, these restrictions, which Wang labels as unfair, could send developers to other provinces and states.

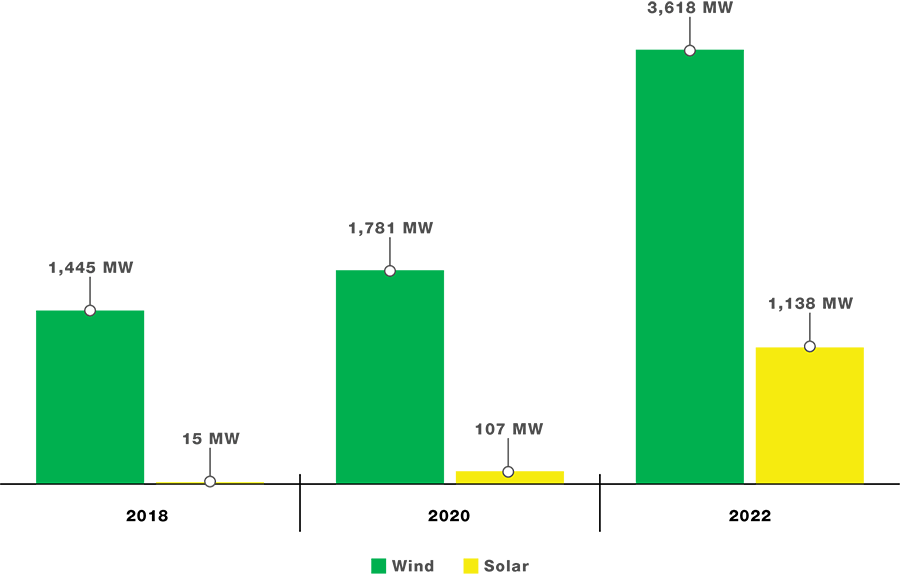

Alberta Renewable Progress

Prior to the moratorium Alberta had been established as a leader in wind and solar, as CanREA notes in their press release, the province held 90% of all renewable growth in 2023. There are approximately 118 projects representing $33B in investments, 24,000 jobs and hundreds of millions in tax and lease revenues impacted as part of the renewable pause.

Feature Image: Canadian Rocky Mountains in the background, near Pincher Creek, Alberta.